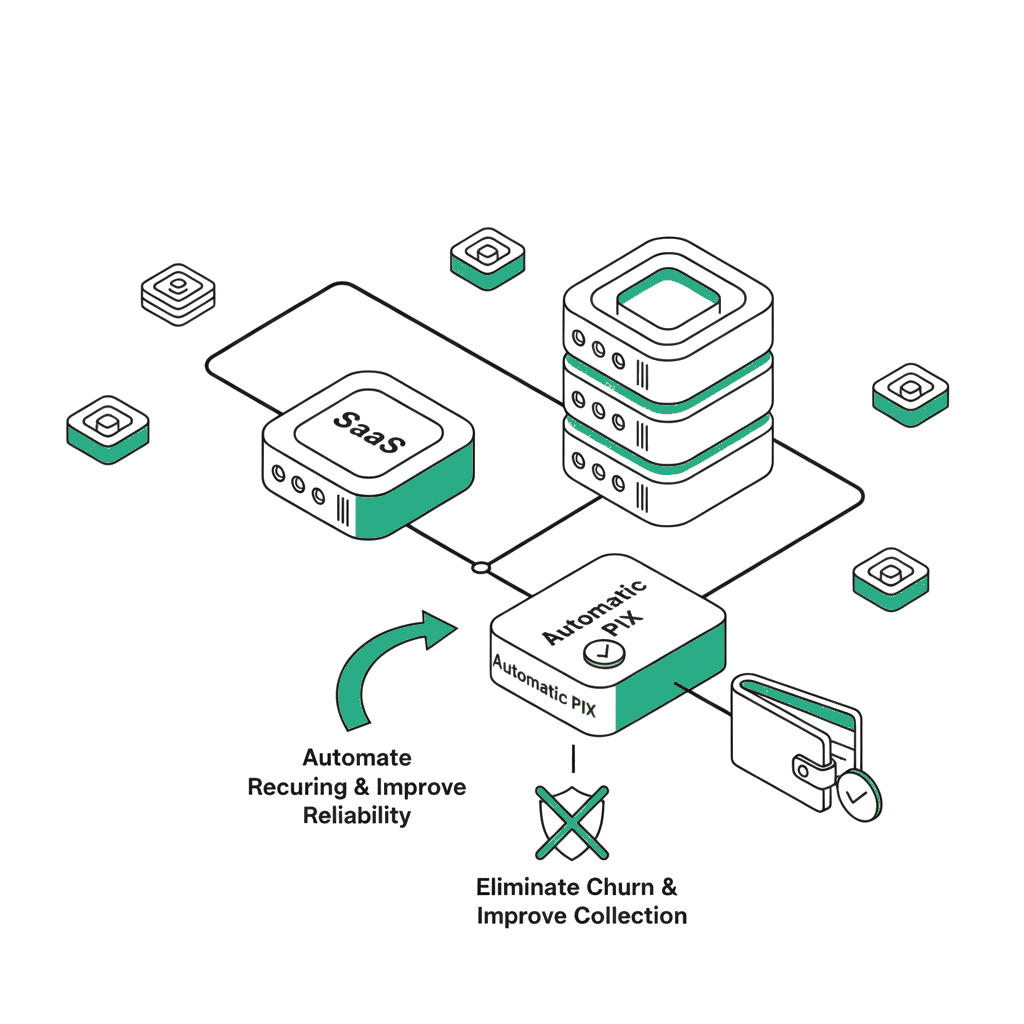

Automatic PIX for SaaS & Subscriptions

Automate recurring billing with consent-based Automatic PIX. Reduce involuntary churn, eliminate manual collection, and improve payment reliability.

Why ZAPPY for SaaS & Subscriptions?

Subscription businesses depend on reliable, automated billing to maintain predictable revenue. ZAPPY's Automatic PIX enables SaaS platforms to collect recurring payments with explicit payer consent, eliminating the failed charge cycles common with card-based billing. Once a subscriber grants consent, payments are processed automatically on schedule with real-time settlement — no expired cards, no payment method updates, and significantly reduced involuntary churn.

SaaS & Subscription Capabilities

Consent-based Billing

Subscribers authorize recurring payments once, and charges are processed automatically — no card expiration issues or payment method failures.

Automated Scheduling

Define billing frequency and amounts, and let ZAPPY handle charge scheduling and processing without manual intervention.

Churn Reduction

Eliminate involuntary churn caused by expired cards or failed payment methods. Automatic PIX uses bank account authorization, not card details.

Lifecycle Webhooks

Receive real-time notifications for every billing event: subscription created, payment processed, payment failed, and consent cancelled.

Flexible Plan Management

Support different billing frequencies, amounts, and plan changes through the API, with full control over the subscription lifecycle.

SaaS & Subscriptions at a Glance

Key features of Automatic PIX for SaaS platforms and subscription businesses.

Automatic PIX with consent

Eliminated

Real-time per charge

Full lifecycle API

Frequently Asked Questions

Related Pages

Ready to transform your payments?

Access the ZAPPY dashboard to manage your PIX payments in real time, track transactions, and configure webhooks. All in one place.