Payment infrastructure for fintechs

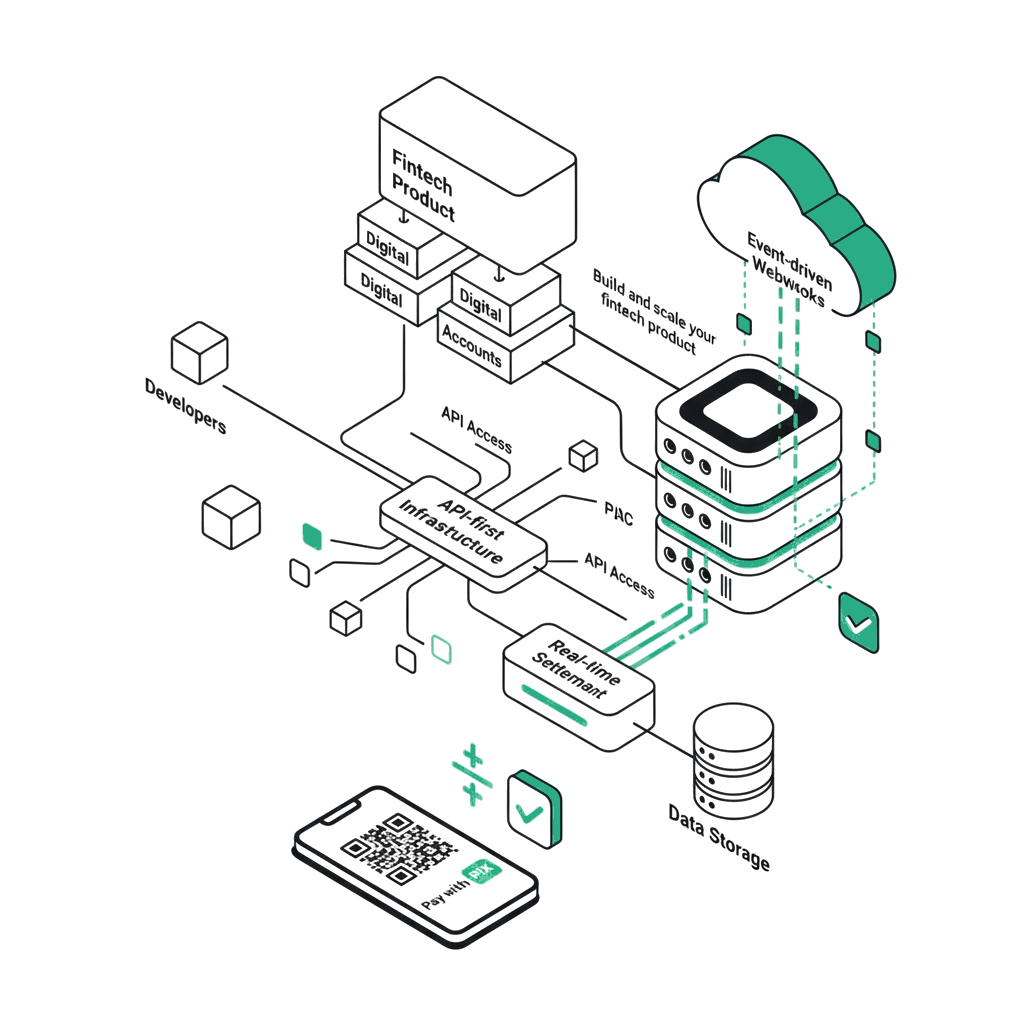

Build and scale your fintech product on a robust, API-first PIX payment infrastructure with digital accounts, real-time settlement, and event-driven webhooks.

Why ZAPPY for Fintechs?

Fintechs need flexible, scalable payment infrastructure they can build upon without managing the complexity of direct Central Bank integrations. ZAPPY provides an API-first platform with complete PIX payment capabilities, digital account management, and real-time event delivery. Whether you are building a neobank, a lending platform, or a payment orchestrator, ZAPPY delivers the infrastructure layer so you can focus on your core product.

Fintech Capabilities

API-first Architecture

Every capability is available through the REST API, enabling deep integration into your fintech product with full programmatic control.

Digital Account Infrastructure

Provision and manage digital accounts for your users with individual balances, statements, and transaction history.

Real-time Settlement

Process PIX payments with instant settlement, providing your users with immediate access to funds upon payment confirmation.

Event-driven Webhooks

Build reactive systems with real-time webhook notifications for every payment event, consent update, and account change.

Scalable Processing

Handle growing transaction volumes with infrastructure designed for high throughput and reliable processing at scale.

Fintechs at a Glance

Key features of ZAPPY's white-label PIX infrastructure for fintechs and financial technology companies.

API-first

Digital account provisioning

Real-time via PIX

Webhook-driven

Frequently Asked Questions

Related Pages

Ready to transform your payments?

Access the ZAPPY dashboard to manage your PIX payments in real time, track transactions, and configure webhooks. All in one place.