Automatic PIX recurring payments

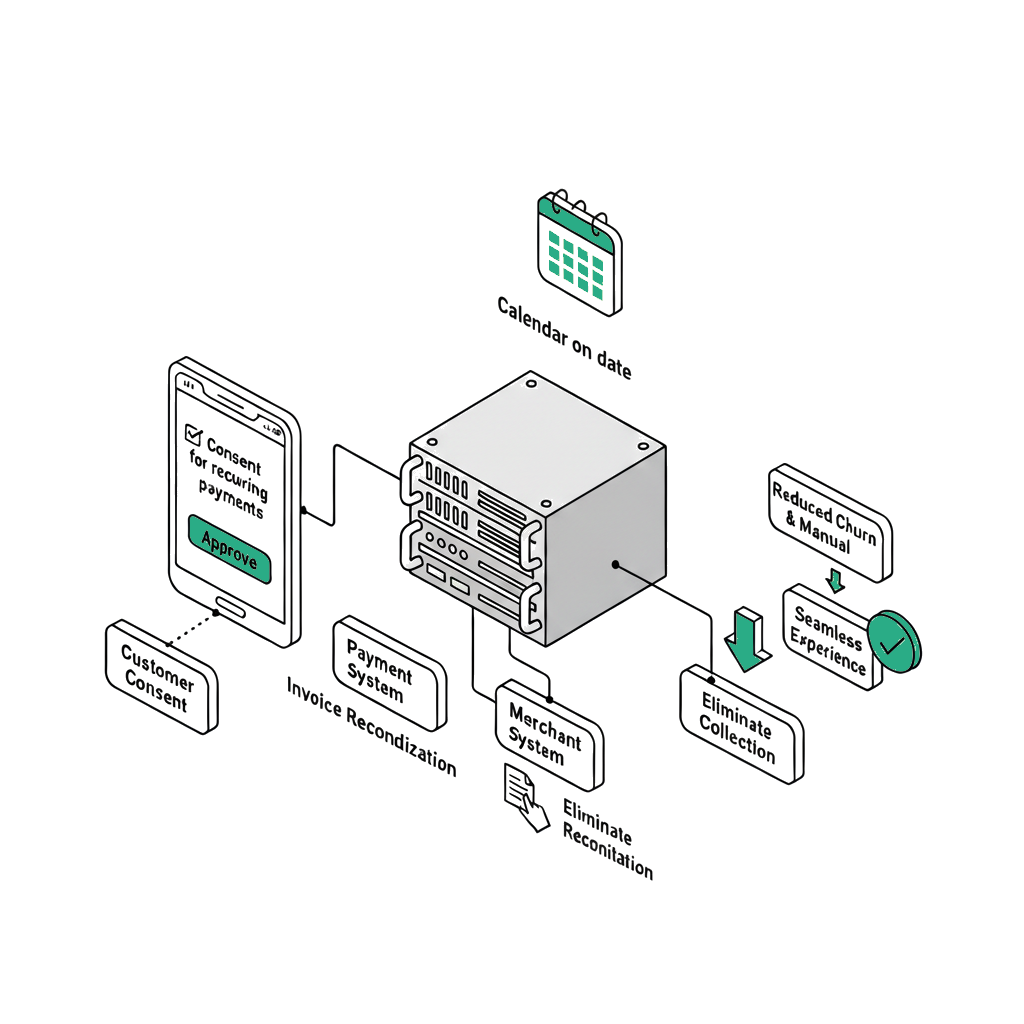

Automate recurring billing with consent-based PIX payments. Reduce churn, eliminate manual collection, and deliver a seamless payment experience.

What is Automatic PIX?

Automatic PIX is a recurring payment method built on Brazil's PIX instant payment system. It enables businesses to collect payments on a scheduled basis with the payer's explicit consent. Unlike traditional recurring billing methods, Automatic PIX operates through the Central Bank's infrastructure, ensuring real-time settlement, full transparency for the payer, and complete lifecycle management — from consent creation through automated billing cycles to flexible cancellation.

Automatic PIX Features

Explicit Consent

Every recurring payment agreement requires the payer's explicit authorization, ensuring transparency and compliance with Central Bank regulations.

Automated Billing

Once consent is approved, charges are processed automatically on the defined schedule — no manual intervention required for each billing cycle.

Lifecycle Management

Manage the complete consent lifecycle from creation to approval, active billing, suspension, and cancellation through a single API.

Real-time Notifications

Receive webhook notifications for every event: consent approved, payment processed, consent cancelled, and billing failures.

Flexible Cancellation

Both payers and receivers can cancel recurring agreements at any time, with automatic notification to all parties involved.

Full Tracking

Track every consent status change and payment event with detailed logs, timestamps, and comprehensive reporting.

Payer Journey: Notification Approval

-

1

The business initiates a consent request through the ZAPPY API, defining the payment amount, frequency, and terms.

-

2

The payer receives a notification in their banking app informing them of the recurring payment request.

-

3

The payer reviews the details — including the amount, billing frequency, and merchant information.

-

4

The payer approves or rejects the recurring payment agreement directly in their banking app.

-

5

The consent status is updated in real time, and ZAPPY sends a webhook notification to the business with the result.

Payer Journey: QR Code Consent

-

1

The business generates a consent QR code through the ZAPPY API with the recurring payment terms.

-

2

The payer scans the QR code using their PIX-enabled banking app.

-

3

The payer reviews the recurring payment terms, including amount, frequency, and start date.

-

4

The payer confirms their consent to the recurring agreement within the banking app.

-

5

The recurring payment agreement is activated and ZAPPY notifies the business via webhook.

Receiver Journey: Consent Creation

-

1

The business defines the recurring payment rules — amount, frequency, start date, and optional end date.

-

2

A consent authorization request is sent to the payer through the ZAPPY API.

-

3

The business tracks the payer's decision in real time through webhooks or API polling.

-

4

Once approved, the consent status transitions to active and the business is notified.

-

5

The system is ready to begin scheduled charges according to the defined billing rules.

Receiver Journey: Automated Billing Lifecycle

-

1

The payer's consent is approved and the recurring agreement becomes active.

-

2

Charges are automatically scheduled according to the defined frequency and amount.

-

3

Each payment is processed through PIX infrastructure with real-time settlement.

-

4

A webhook notification is sent to the business confirming each successful or failed charge.

-

5

The billing cycle continues automatically until the agreement is cancelled or expires.

Automatic PIX at a Glance

Key aspects of Automatic PIX and how it works within the ZAPPY infrastructure.

Explicit payer consent

Automated scheduling

Real-time via PIX

Full lifecycle API

Frequently Asked Questions

Related Pages

Ready to transform your payments?

Access the ZAPPY dashboard to manage your PIX payments in real time, track transactions, and configure webhooks. All in one place.