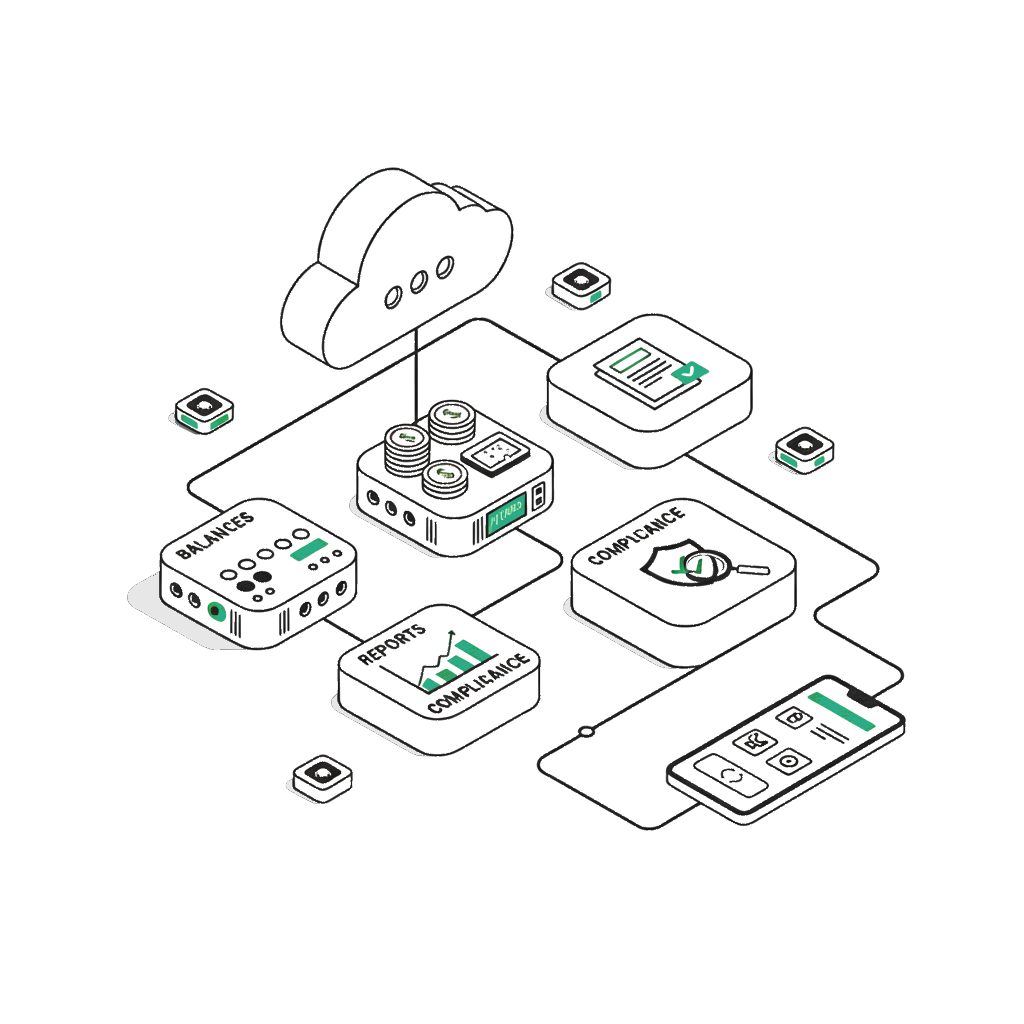

Digital account infrastructure

Manage balances, access statements, generate reports, and maintain compliance with a fully integrated digital account platform.

What are Digital Accounts?

Digital Accounts at ZAPPY provide a complete financial account infrastructure for businesses. Each account includes real-time balance management, detailed transaction statements, exportable financial reports, and built-in KYC verification. Managed through the API or the dashboard, digital accounts serve as the foundation for receiving PIX payments, executing transfers, and maintaining full financial visibility.

Digital Account Capabilities

Balance Management

Track available and pending balances in real time, with automatic updates as PIX payments are received and transfers are processed.

Statements

Access detailed transaction statements with filtering by date range, transaction type, and status for complete financial visibility.

Reports

Generate and export comprehensive financial reports for reconciliation, accounting, and business intelligence purposes.

KYC Verification

Complete the Know Your Customer verification process to activate your account and ensure compliance with regulatory requirements.

Account Management

Configure account settings, manage PIX keys, register bank accounts for withdrawals, and control access permissions through a unified interface.

Digital Accounts at a Glance

Key features and capabilities of ZAPPY digital accounts for financial management.

Real-time

Filterable and exportable

Built-in verification

API and dashboard

Frequently Asked Questions

Related Pages

Ready to transform your payments?

Access the ZAPPY dashboard to manage your PIX payments in real time, track transactions, and configure webhooks. All in one place.